A new survey of automakers and Tier 1 suppliers conducted by Ducker Carlisle concludes that as electric vehicles continue to enter the mass market, aluminum demand will grow through the end of the decade. The report, “2023 North American Light Vehicle Aluminum Content and Outlook,” released today by the Aluminum Association indicates that demand for more sustainable transportation will help drive an increase in market share for aluminum content by nearly 100 net pounds per vehicle (PPV) from 2020 to 2030.

“Consumers want cars and trucks that are more sustainable, more electrified and filled with more technology, and automakers are responding with a host of innovations, all enabled by high-strength, low weight and infinitely recyclable aluminum,” said Mike Keown, chair of the Aluminum Transportation Group and CEO of Commonwealth Rolled Products. “The aluminum industry is committed to ensuring consumers experience the performance and environmental benefits of aluminum as more and more vehicles are designed with the metal in the years ahead. Greater collaboration with automakers will bring to life this vision, set forth by the aluminum industry in its 10-year roadmap. And as mega-casting and closed-loop recycling continue to advance, aluminum producers remain vital partners in helping automakers achieve aggressive carbon neutral targets.”

The report, which reflects data collected during an 8-month period through interviews with leading automakers, Tier 1 suppliers and aluminum producer companies, identifies five key market themes:

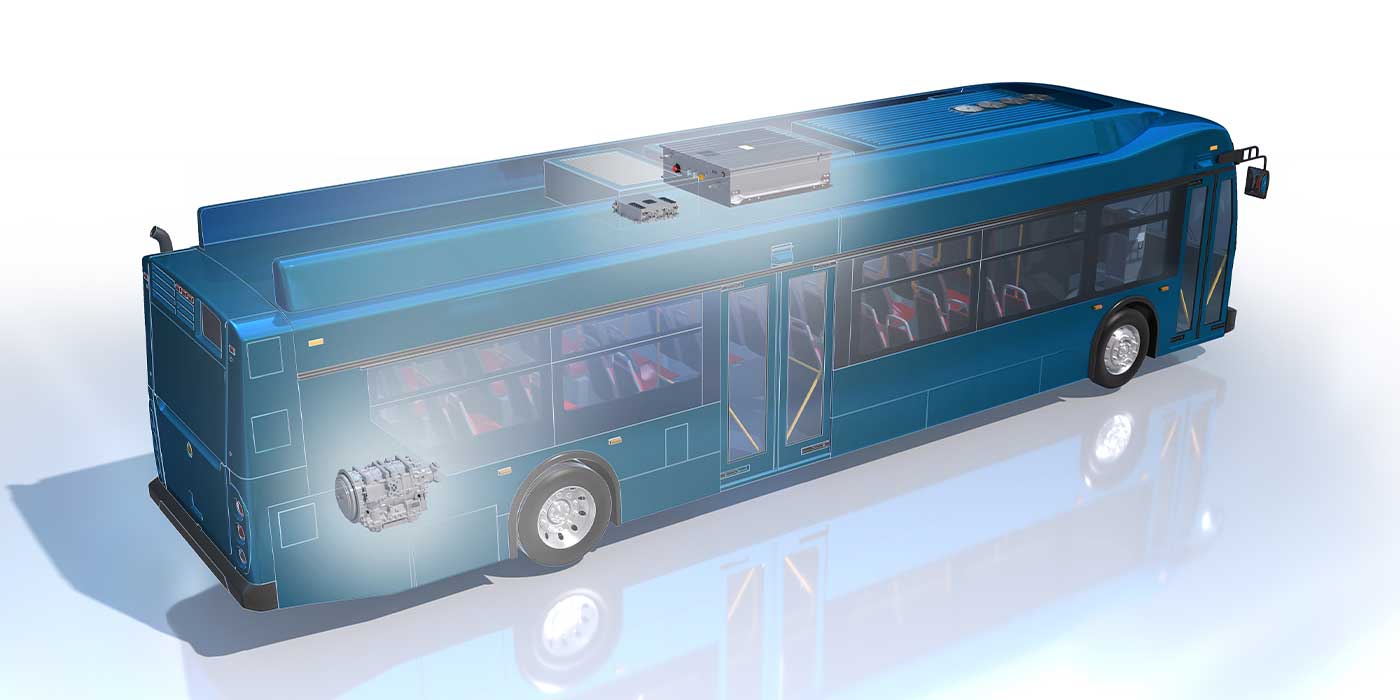

- Proliferation of BEVs will dramatically change the NA light vehicle landscape. BEV share of production nearly doubled from just under 3% in 2020 to approximately 6% in 2022. By 2030, BEVs, which on average are more aluminum-intensive, are expected to exceed 36% share of production.

- Trend toward larger vehicles that have more aluminum content per vehicle. Consumers affinity toward larger vehicles continues, helping drive increased aluminum growth. In 2022, light trucks outnumbered cars four to one and contained more than 30% more aluminum than cars.

- Aggressive CO2 and Miles Per Gallon (MPG) regulatory targets helping drive EV adoption and aluminum growth. Recent federal regulation ushering in more stringent CO2 and MPG targets expected for 2027 to 2030 incentivizes EV adoption and helps further drive aluminum growth.

- Aluminum content per vehicle continues its uninterrupted growth. A net gain of 56 pounds per vehicle is expected between 2020 and 2025 with aluminum growing by almost 100 net PPV between 2020 and 2030 to 550 PPV, a 233% increase over 1990, when aluminum accounted for just 165 PPV.

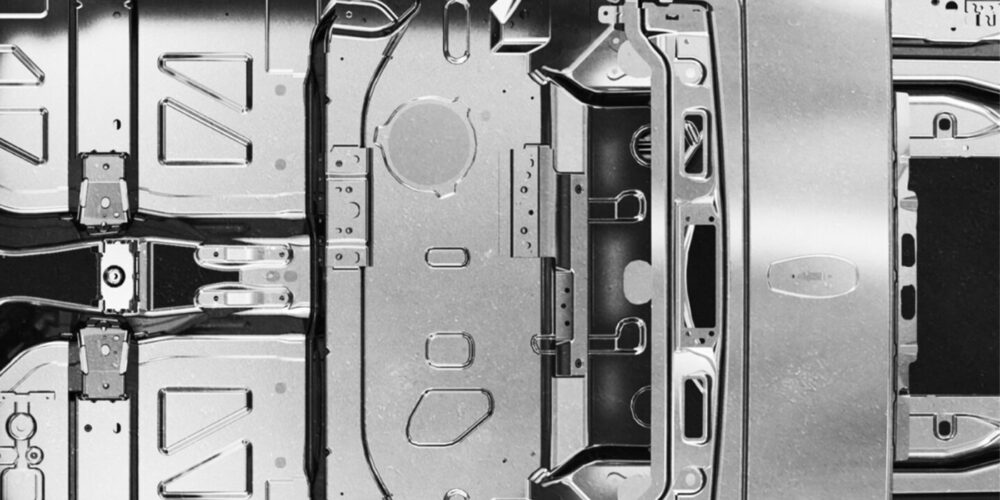

- Near term aluminum growth led by extrusions and sheet. Extrusions demonstrate significant growth within the body-in-white (BIW) and crash management systems (CMS) gaining 47 pounds per vehicle from 2020 to 2030, becoming the fastest growing product form, while auto body sheet (ABS) and sheet for thermal management systems will increase 41 PPV from 2020 to 2030. Castings remain the largest aluminum product form, but growth is limited as powertrain and transmission components are replaced by e-drives, battery housings, high-voltage devices, etc.

“Electrification positively affects aluminum content and compensates for the transition away from powertrain and transmission components, which are primarily aluminum,” said Abey Abraham, principal of automotive and materials at Ducker Carlisle. “As electrified powertrains create significant growth opportunities for aluminum, more stringent fuel economy standards also continue to promote mass reduction in ICE vehicles.”

Additional findings from the triannual “North American Light Vehicle Aluminum Content and Outlook” include:

- Key components for aluminum growth on EVs between 2022 and 2030 include battery housings, e-motors and drives, door sills and rockers.

- By 2030, battery electric light-trucks are expected to average 644 pounds of aluminum content.

- SUVs and pickups will make up nearly 85% of the BEV market by 2030.

A thriving automotive aluminum sector remains vital to the nation’s manufacturing base and a healthy U.S. economy. The aluminum industry invested or committed more than $7 billion to ensure increased automotive capacity in the U.S. since 2013, and the industry is prepared to continue such investments in domestic manufacturing jobs as demand continues to grow.

To view the study, visit DriveAluminum.org/ducker2023